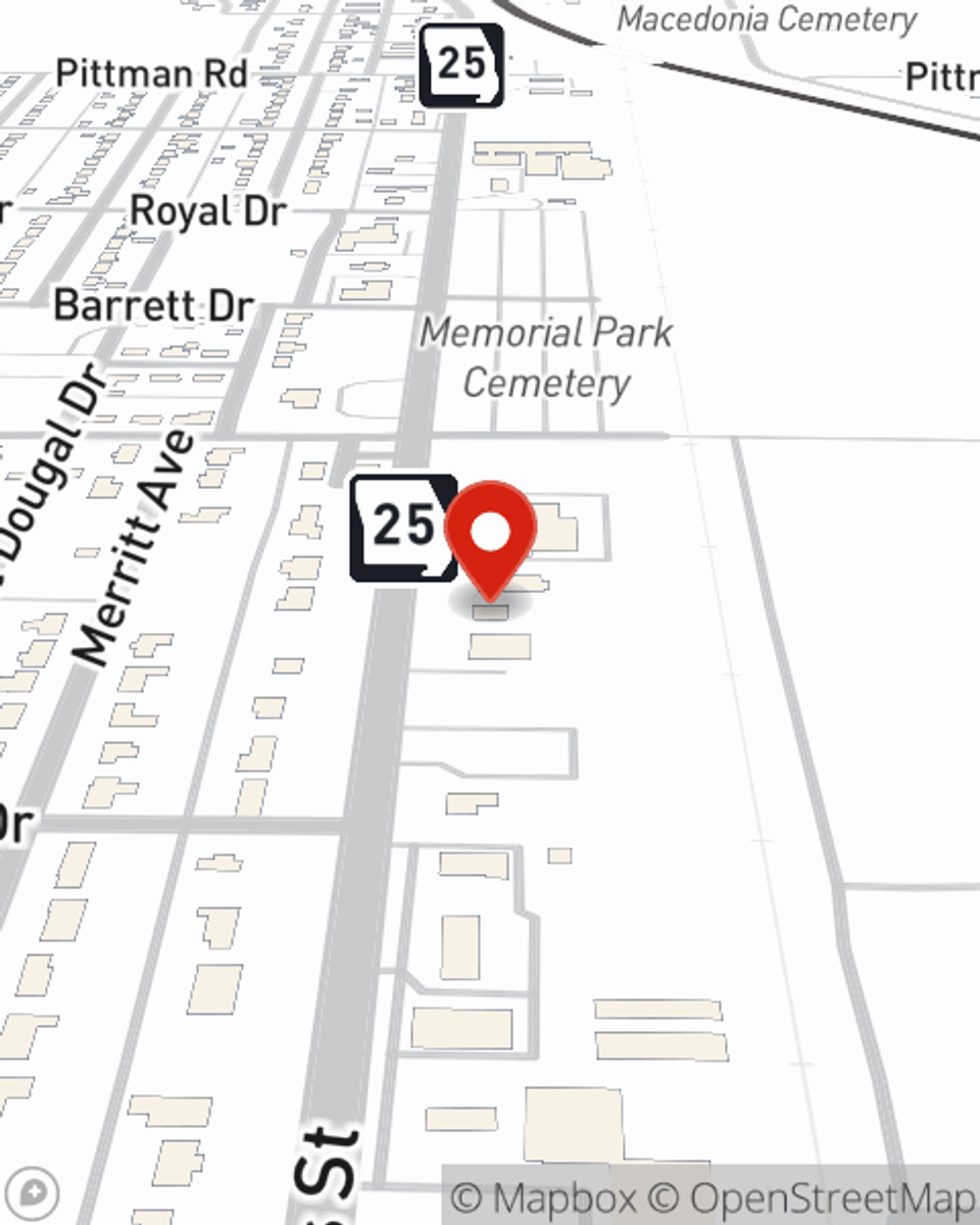

Business Insurance in and around Malden

Looking for small business insurance coverage?

Cover all the bases for your small business

Coverage With State Farm Can Help Your Small Business.

When you're a business owner, there's so much to keep track of. You're in good company. State Farm agent Matt Steward is a business owner, too. Let Matt Steward help you make sure that your business is properly insured. You won't regret it!

Looking for small business insurance coverage?

Cover all the bases for your small business

Keep Your Business Secure

If you're looking for a business policy that can help cover loss of income, buildings you own, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

At State Farm agent Matt Steward's office, it's our business to help insure yours. Visit our excellent team to get started today!

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Matt Steward

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.